Division B, Road No. 1, Hiep Phuoc Industrial Park, Hiep Phuoc Commune, Ho Chi Minh City, Vietnam

Contact with us

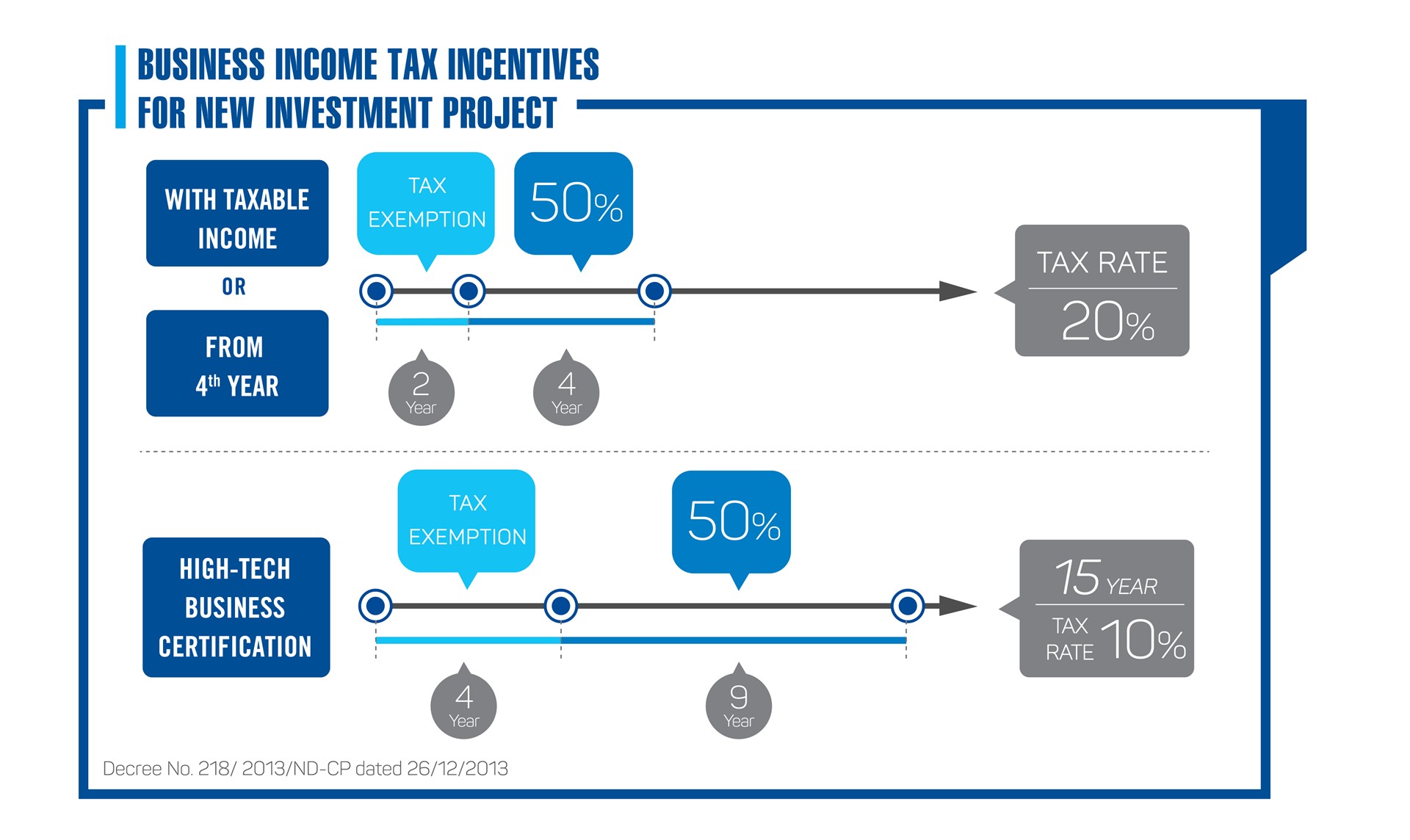

(Regulated in Decree No. 218/2013/ND-CP dated December 26, 2013 of the Government detailing and guiding the implementation of the Law on Corporate Income Tax; Decree No. 12/2015/ND-CP guiding the Law amending and supplementing a number of articles of the Laws on Taxes and amending and supplementing a number of articles of the Decrees on Taxes (effective from January 1, 2014)

1) Preferential tax rate of 10% for 15 years. Tax exemption for 4 years, 50% reduction of tax payable for the next 9 years for the following cases:

- Enterprise income from implementing new investment projects in the following fields: Scientific research and technology development; application of high technology in the list of high technologies prioritized for investment and development according to the provisions of the Law on High Technology; incubation of high technology, incubation of high-tech enterprises; venture investment in developing high technology in the list of high technologies prioritized for development according to the provisions of the law on high technology; investment in construction - operating high-tech incubators and high-tech enterprise incubators; investing in the development of water plants, power plants, water supply and drainage systems; bridges, roads, railways; airports, seaports, river ports; airports, train stations and other particularly important infrastructure works decided by the Prime Minister; manufacturing software products (investment projects to produce software products in the software product category and meet the software product production process as prescribed by law); production of composite materials, light construction materials, rare materials; production of renewable energy, clean energy, energy from waste destruction; development of biotechnology.

- Enterprise income from implementing new investment projects in the field of environmental protection, including: Production of environmental pollution treatment equipment, environmental monitoring and analysis equipment; pollution treatment and environmental protection; collection and treatment of wastewater, exhaust gas, solid waste; recycling and reuse of waste;

- Enterprise income from implementing investment projects in the manufacturing sector, except for projects producing goods subject to special consumption tax and mineral exploitation projects, with a minimum investment capital scale of VND 12,000 (twelve thousand) billion, using technology that must be appraised according to the provisions of the Law on High Technology, the Law on Science and Technology, and disbursement of total registered investment capital must not exceed 5 years from the date of investment permission according to the provisions of the law on investment.

- High-tech enterprises as prescribed by the Law on High Technology (enjoy preferential tax rates from the year of being granted the Certificate of High-tech Enterprise).

- Enterprise income from implementing new investment projects in the manufacturing sector (except for projects producing goods subject to special consumption tax, mineral exploitation projects) that meet one of the following two criteria:

+ The project has a minimum investment capital scale of 6 (six) trillion VND, disbursement is made no later than 3 years from the time of first investment permission according to the provisions of the law on investment and has a total minimum revenue of 10 (ten) trillion VND/year no later than 3 years from the year of revenue.

+ The project has a minimum investment capital of 6 (six) thousand billion VND, disbursement is made no later than 3 years from the time of first investment permission according to the provisions of the law on investment and regular employment of more than 3,000 employees no later than 3 years from the year of revenue generation. The number of employees regularly employed is determined according to the provisions of the law on labor.

- Enterprise income from implementing new investment projects to produce products in the List of priority supporting industrial products for development that meet one of the following criteria:

+ Industrial products supporting high technology according to the provisions of the Law on High Technology;

+ Industrial products supporting the production of products in the following industries: Textile - garment; leather - footwear; electronics - information technology; automobile manufacturing and assembly; mechanical engineering, which as of January 1, 2015 cannot be produced domestically or can be produced but must meet the technical standards of the European Union (EU) or equivalent.

- Income of enterprises from socialization activities in the fields of education - training, vocational training, healthcare, culture, sports and environment (List of types, scale criteria and standards of enterprises implementing socialization as prescribed by the Prime Minister);

- Enterprise income from implementing investment projects - social housing business for sale, lease, and hire-purchase for subjects specified in Article 53 of the Housing Law.

2) The corporate income tax rate is 22% from January 1, 2014, and the corporate income tax rate is 20% from January 1, 2016.

Tax exemption for 2 years, 50% reduction of tax payable in the next 4 years. The tax exemption and reduction period is calculated continuously from the first year of taxable income from the new investment project enjoying tax incentives. In case there is no taxable income in the first three years, from the first year of revenue from the new investment project, the tax exemption and reduction period is calculated from the fourth year.

This tax exemption and reduction incentive is applied to newly established enterprises from investment projects in industrial parks located in suburban districts of Ho Chi Minh City including: DONG NAM INDUSTRIAL PARK, HO CHI MINH AUTOMOBILE MECHANICAL PARK, AN HA, LE MINH XUAN, LE MINH XUAN 2, LE MINH XUAN 3; HIEP PHUOC GĐ1, 2; TAY BAC CU CHI, TAN PHU TRUNG, BAU DUONG, PHUOC HIEP, XUAN THOI THUONG, VINH LOC 3, PHONG PHU (except for the cases specified in Section 1).

(According to the provisions of Article 12, Decree 87/2010/ND-CP of the Government dated August 13, 2010 on detailed regulations for the implementation of a number of articles of the Law on export tax and import tax).

Exported and imported goods in the following cases are exempt from export tax and import tax:

- Temporarily imported, re-exported or temporarily exported, re-imported goods to participate in fairs, exhibitions, product introductions; machinery, equipment, professional tools temporarily imported, re-exported or temporarily exported, re-imported to serve work within a certain period of time. After the fair, exhibition, product introduction period ends or the work is completed according to the provisions of law, temporarily exported goods must be re-imported into Vietnam, temporarily imported goods must be re-exported abroad.

- Goods are movable assets of Vietnamese or foreign organizations and individuals brought into Vietnam or taken abroad within prescribed limits, including:

- Export and import goods of foreign organizations and individuals enjoying diplomatic privileges and immunities in Vietnam.

- Imported goods for processing for foreign parties are exempt from import tax (including imported goods for processing for foreign parties that are allowed to be destroyed in Vietnam according to the provisions of law after liquidation and settlement of processing contracts) and when returning products to foreign parties, they are exempt from export tax. Goods exported abroad for processing for Vietnamese parties are exempt from export tax, when re-imported, they are exempt from import tax on the value of the goods exported abroad for processing under the contract.

- Exported and imported goods within the tax-free luggage standards of people exiting and entering the country; goods are postal items and parcels of express delivery services with minimum taxable value according to regulations of the Prime Minister.

- Imported goods to create fixed assets of investment projects in fields with import tax incentives specified in Appendix I on the List of fields with import tax incentives (attached) or areas with import tax incentives, investment projects using official development assistance (ODA) capital are exempted from import tax, including:

- First-time tax exemption for goods being imported equipment according to the list specified in Appendix II on the List of equipment groups exempted from first-time import tax (attached) to create fixed assets of projects with preferential import tax, investment projects using official development assistance (ODA) capital, investment in hotels, offices, apartments for rent, houses, commercial centers, technical services, supermarkets, golf courses, tourist areas, sports areas, entertainment areas, medical examination and treatment facilities, training, culture, finance, banking, insurance, auditing, consulting services. Projects with imported goods exempted from tax for the first time are not exempted from tax according to the provisions in other clauses.

- Exemption from import tax on raw materials and supplies directly serving the production of software products that cannot be produced domestically.

- Exemption from import tax on imported goods for direct use in scientific research and technological development activities, including: machinery, equipment, spare parts, supplies, means of transport that cannot be produced domestically, technology that cannot be created domestically; documents, books, newspapers, scientific magazines and electronic sources of information on science and technology.

- Raw materials, supplies and components that are not yet produced domestically are imported for production of investment projects in sectors with special investment incentives specified in Appendix I on the List of sectors enjoying import tax incentives (attached) or in areas with particularly difficult socio-economic conditions (except for projects to manufacture and assemble automobiles, motorbikes, air conditioners, electric heaters, refrigerators, washing machines, electric fans, dishwashers, disc players, audio systems, electric irons, kettles, hair dryers, hand dryers and other items as decided by the Prime Minister) are exempted from import tax for a period of 05 (five) years from the date of commencement of production.

- Goods manufactured, processed, recycled, or assembled in duty-free zones that do not use imported raw materials or components from abroad are exempt from import tax when imported into the domestic market; in cases where imported raw materials or components are used, when imported into the domestic market, import tax must only be paid on the imported raw materials or components that make up the goods.

- Machinery, equipment, and means of transport (except for cars with less than 24 seats and cars designed to carry both people and goods equivalent to cars with less than 24 seats) imported by foreign contractors under the temporary import and re-export method to implement ODA projects in Vietnam are exempt from import tax when temporarily imported and exempt from export tax when re-exported.

- Areas with import tax incentives are implemented according to the List of areas with corporate income tax incentives issued together with Decree No. 53/2010/ND-CP dated May 19, 2010 regulating areas with investment incentives and corporate income tax incentives for newly established administrative units due to the Government adjusting administrative boundaries.